property tax on leased car connecticut

In all cases the tax assessor will bill the dealership for the taxes and the dealership will pay. If the lease states that you are responsible for these taxes you will then receive a bill from the dealership.

General Information Assessment And Collection

Office of Policy and Management.

. On a nationwide scale Connecticut homeowners pay the fourth highest property taxes in the US. All tax rules apply to leased vehicles. There are different mill rates for different towns and cities.

You may use this calculator to compute your Property Tax Credit if. If you pay personal property tax on a leased. In most cases the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the lessee most.

This may be a one-time annual payment or it may. To learn more see a full list of taxable and tax-exempt items in. One or both of the following statements apply.

The terms of the lease will decide the responsible party for personal property taxes. The maximum credit allowed on your motor vehicle is 200 per return regardless of filing status. While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

This page describes the taxability of leases and rentals in Connecticut including motor vehicles and tangible media property. The taxing process for motor vehicles is the same for other taxable property in Connecticutthe tax rate of the property is assessed at 70 of fair market value which is determined by a local assessor. Yes you may take a credit against your 2016 Connecticut income tax liability for qualifying property tax payments you made to your Connecticut town or taxing district on your privately owned or leased motor vehicle or both.

2021 PROPERTY TAX CREDIT CALCULATOR. Page 1 of 1 Mill Rates A mill rate is the rate thats used to calculate your property tax. Heres how it works.

Municipal appraisers in these municipalities are responsible for allocating leased cars to the appropriate tax districts. 2021 Property Tax Credit Calculator. However the bill is mailed directly to the leasing company since leased cars are registered in the companys name.

You are a Connecticut resident AND. 170 rows The local property tax is computed and issued by your local tax collector. I know this is considered a tax deduction.

In Groton and Middletown evaluators said they used all available information from the DMV to find rented cars. To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000. But most of Connecticuts 71 independent fire departments do.

Paid qualifying property tax on your PRIMARY RESIDENCE ANDOR MOTOR VEHICLE during 2021 AND. Connecticut is unusual in that counties are not. However they could issue a lease contract that says that the lessee is solely responsible.

The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or dealer. The states average effective property tax rate is 214 which is double the 107 national average. If you terminate your lease it is very important that you provide the Tax Assessors with a return of plate receipt or a letter from your insurance company showing the vehicle cancelled.

Connecticut Leasees Property Taxes Off Ramp Forum Leasehackr

Which U S States Charge Property Taxes For Cars Mansion Global

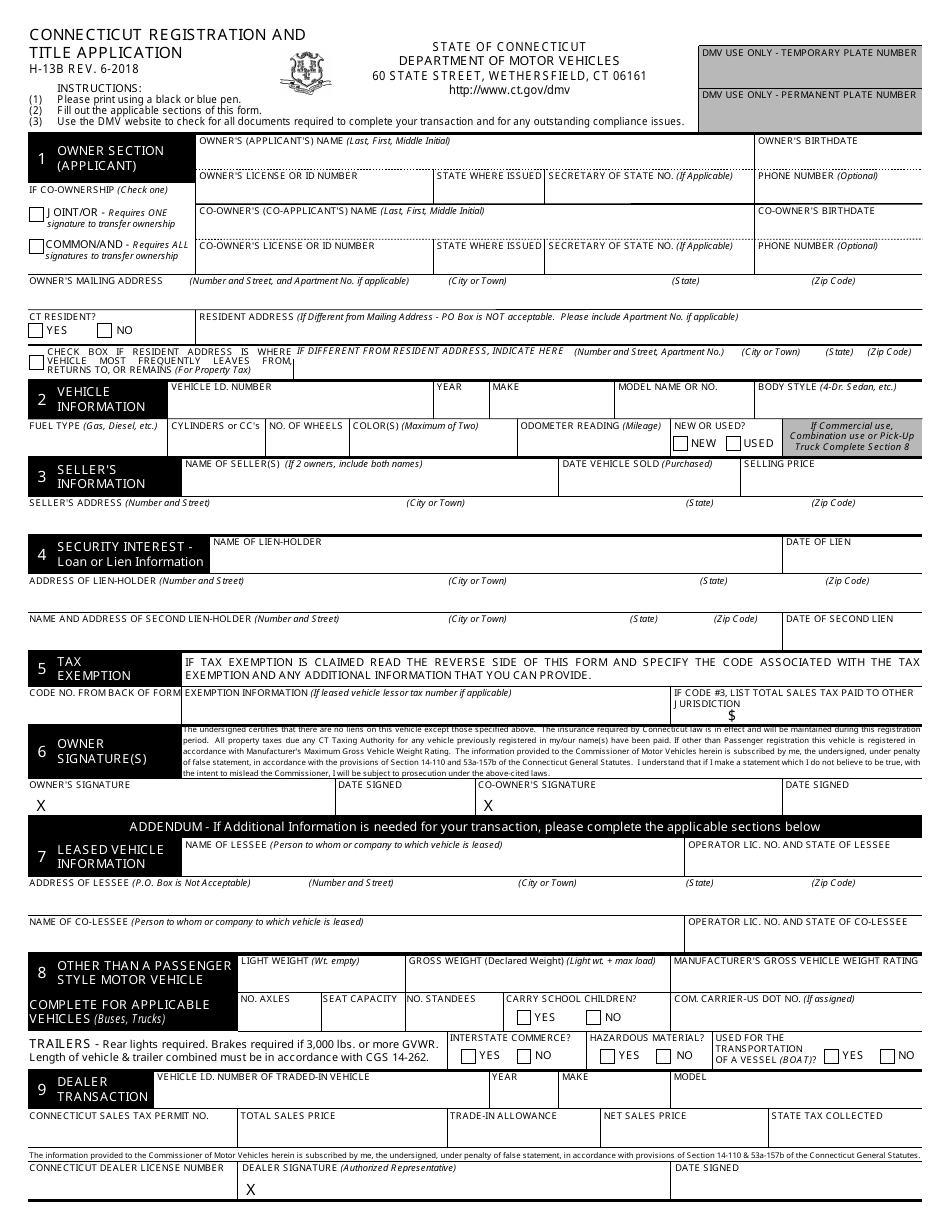

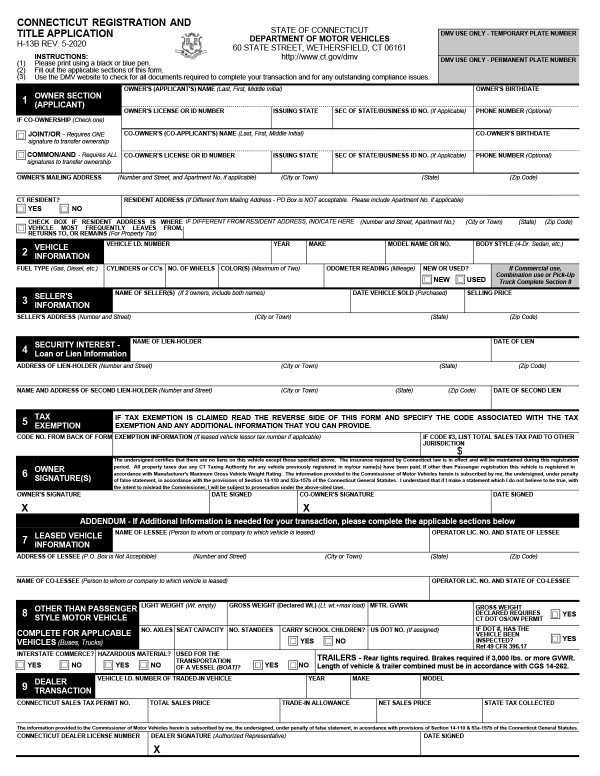

Form H 13b Download Fillable Pdf Or Fill Online Connecticut Registration And Title Application Connecticut Templateroller

Connecticut S Sales Tax On Cars

Learn How To Get Money For Your Car Lease Atax Center Llc

Connecticut Bill Of Sale Templates And Registration Requirements

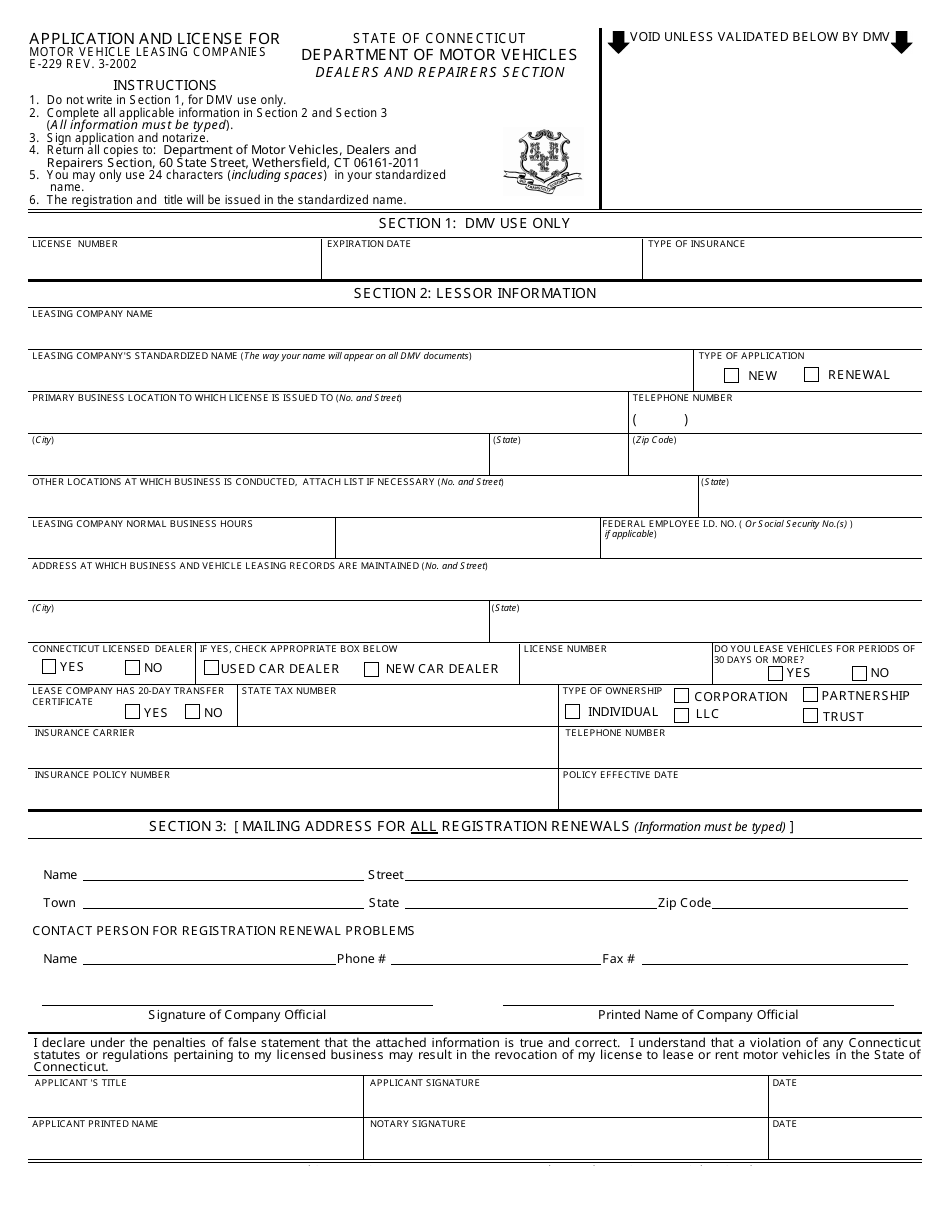

Form E 229 Download Fillable Pdf Or Fill Online Application And License For Motor Vehicle Leasing Companies Connecticut Templateroller

7 On Your Side How To Avoid Car Lease Buy Out Rip Offs Abc7 New York

2022 Nissan Maxima Lease Deals 0 Down Specials Ny Nj Pa Ct

Consider Selling Your Car Before Your Lease Ends Edmunds

Who Pays The Personal Property Tax On A Leased Car

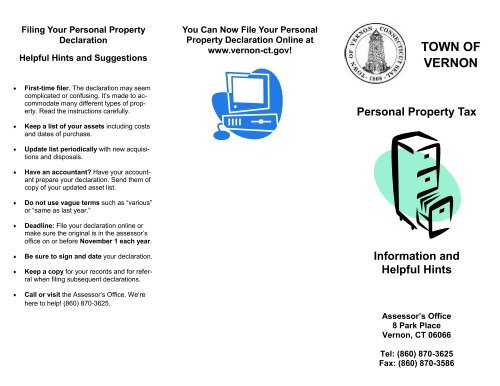

Personal Property Tax Town Of Vernon

Who Pays Personal Property Taxes On Leased Vehicles In Missouri Slfp

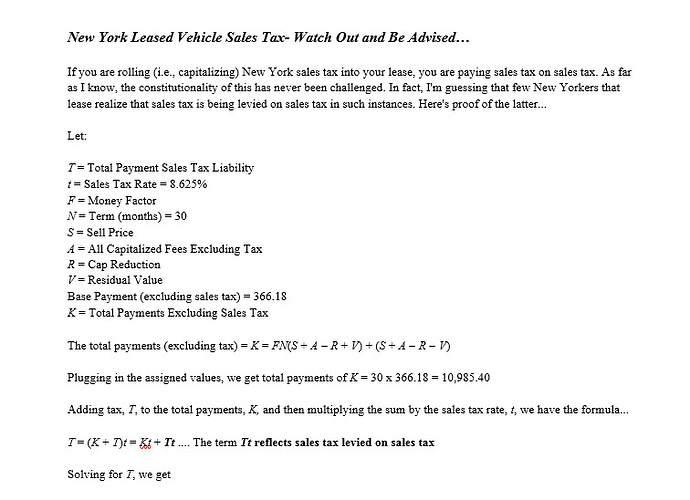

Sales Tax In Ny Off Ramp Forum Leasehackr

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars